Monthly Report September 2024

Will the anticipated rate cuts boost economic growth or signal an impending recession?

Two-thirds of 2024 are now behind us, and the stock markets have performed well so far. August, typically a quiet summer month, saw some turbulence this year. A sharp decline at the start of the month, probably triggered by the unwinding of the “Yen Carry Trade” following the hike in Japanese interest rates, was followed by an impressive rally.

Year-to-date, the S&P 500 and the Nasdaq Composite in the US have each gained 18%. The MSCI World and Japan’s Nikkei 225 have risen by over 15%. Switzerland’s SMI has advanced 12%, while the pan-European Euro Stoxx 50 has climbed nearly 10%. In contrast, China’s Shanghai Composite has dropped some 4%.

Gold, trading near its all-time high at over $2,500 per ounce, has surged by more than 22% this year. Meanwhile, in the bond market, the iShares 20+ Year Treasury Bond ETF (TLT) has declined by just over 2% as of the end of August.

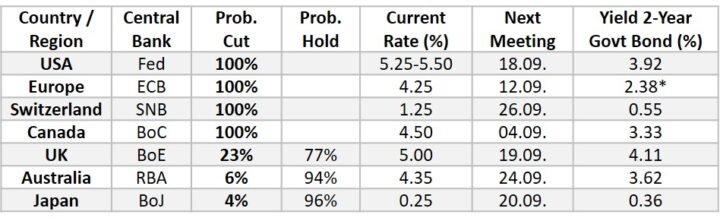

In the coming weeks, markets will focus on the interest rate decisions of the major central banks. The table below indicates the probability (Prob.) that money markets are expecting or have already priced in for a rate cut in September. Particular attention will be on the decision of the US Federal Reserve. Current market expectations point to a 70% probability of a 25 basis point (bps) cut, and a 30% chance of a 50 bps reduction (Source: CME FedWatch Tool, August 30, 2024).

Source: own illustration as of Friday, August 30, 2024 *Germany

As indicated by 2-year yields, policy rates are likely to continue declining in the months ahead, with the exception of Japan. Cynics might say that 2-year yields are the “most important member” of central bank’s decision-making committee, given their accuracy in forecasting changes in interest rates…

Falling rates are inversely proportional to bond prices, which should theoretically support their price development. However, longer-duration yields are influenced more by anticipated growth and inflation outlooks than by central bank policies. Additionally, supply and demand dynamics play a secondary role in the pricing of long-term bonds.

In stock markets, there is often a Pavlovian reflex that lower rates are beneficial for stock prices. However, closer examination and anecdotal evidence suggest that the initiation of rate cuts by the Fed is frequently associated with a recession and declining stock prices. We believe that correlation and causation are being conflated here. Simply put, if rate cuts are a response to an impending recession, they tend to be negative, as lower future earnings outweigh the benefit of a reduced discount rate. Conversely, if rate cuts occur in a relatively calm economic environment with solid corporate earnings, they are generally viewed more positively.

For gold, lower interest rates are fundamentally positive. Additional support may come from geopolitical tensions and economic troubles in China.

Regarding currencies, the expected shift in interest rates suggests a stronger JPY. Conversely, the USD may struggle according to the “Dollar Smile” theory. This theory postulates that the USD performs well either during strong global upswings (often led by the US economy) or during global recessions (flight to safety and liquidity). A soft landing or a “business as usual” environment is not particularly favorable for the Greenback.

Below are some seasonal trends over the past 20 years for the month of September:

- The worst month for the S&P 500, a trend that has persisted over the last four years despite a bull market.

- The second-worst month for the DAX, followed by a strong three-month period.

- The worst month of the year for the MSCI World Index.

- September marks the start of a weak three-month seasonal phase for WTI crude oil.

- The worst month for gold.

- The second-worst month for silver.

In this context, we favor genuine, structural portfolio diversification. In equities, we maintain a slight overweight in defensive and rate-sensitive sectors such as utilities, real estate, healthcare, consumer staples, and insurance. In the bond sector, we have additionally built up medium-duration bonds (3 to 7 years). Among corporate bonds, we prefer investment-grade over high-yield bonds. Our gold allocation remains unchanged.

As an interesting portfolio addition and additional hedge, we consider JPY money market funds. This is because the interest rate differential is expected to shift in favor of the Japanese yen in coming months, and the JPY remains significantly undervalued based on purchasing power parity. This could lead to the JPY appreciating against most other major trading currencies. Moreover, we witnessed in early August the turbulence that a strong and rapid appreciation of the JPY can cause across most other markets.

Quote from the campaign speech: La Libertad Avanza, October 22, 2021, in Las Palomas, Buenos Aires, Argentina

Milei, J. (2021), https://quotesonfinance.com/quote/141/javier-milei-if-printing-money-would-end-poverty