Quarterly Outlook Q1 2025

The year ended with volatile bonds and strong stock markets – early trends for 2025 point to continued momentum.

Review

Fixed Income

The US Federal Reserve cut its benchmark interest rates by a total of 100 basis points (bps) across its final three meetings of 2024, bringing the federal funds rate to 4.50%. This decisiveness was accompanied by a significant rise in the yields of 10-year US Treasury bonds, which increased by more than 100bps from 3.62% on 18 September – the date of the Fed’s first rate cut – to 4.63% by year-end. The yield settled marginally lower at 4.57% as the year closed. For the first time since 1984, long-term interest rates rose even as the Fed started its monetary policy easing cycle. This atypical yield surge triggered a sharp decline in the iShares 20+ Year Treasury Bond ETF (TLT), which plummeted by 11.0% in the 4th quarter, contributing to a full-year loss of 11.7%. Meanwhile, yields on two-year US Treasuries also climbed, rising from approximately 3.60% to 4.24% over the same period. Markets now turn their attention to upcoming Fed meetings on 29 January and 19 March, with expectations for the next rate cut pushed to March at the earliest.

In the euro area, the increase in long-term sovereign bond yields was more restrained during the 4th quarter. The yield on 10-year German bunds edged up from 2.13% to 2.36%, while comparable Italian bonds ended the year at 3.52%, up slightly from 3.47% at the end of September. As a result, the spread between German and Italian yields narrowed to less than 120bps. Notably, Spanish bonds, and at times even 10-year Greek sovereigns, traded at lower yields than French bonds. The European Central Bank (ECB) cut its main refinancing rate by 25bps to 3.15% on 12 December, with its next policy meetings scheduled for 30 January and 6 March.

In the United Kingdom, the yield on 10-year gilts rose from 4.00% to 4.57% over the 4th quarter, even as the Bank of England (BoE) reduced its key policy rate by 25bps to 4.75%. The BoE’s next meeting is set for 6 February, with markets closely watching for any further moves.

In Japan, yields on 10-year Japanese government bonds (JGBs) climbed from 0.86% to 1.07% during the quarter. The Bank of Japan maintained its key rate at 0.25% over the same period, and analysts see only a slim chance of a rate hike at its next meeting on 24 January.

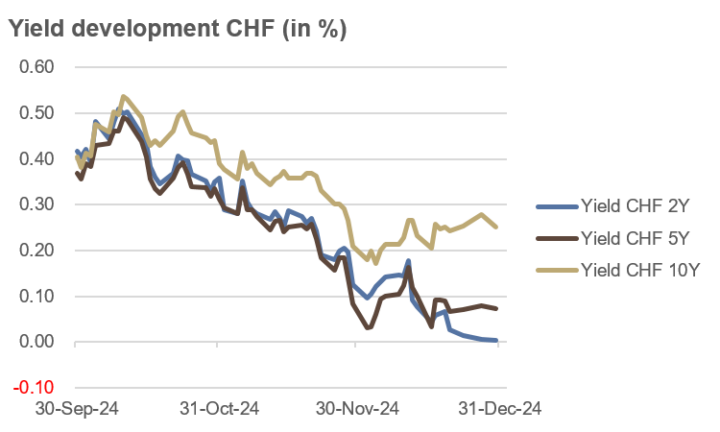

Switzerland, by contrast, experienced a decline in bond yields across the curve. 10-year Swiss government bonds ended the year at 0.25%, while five-year and two-year yields fell to 0.07% and near zero, respectively. Under its new chairman, Martin Schlegel, the Swiss National Bank (SNB) surprised markets on 12 December with a “significant” 50bps rate cut, bringing its policy rate to 0.50%. Another round of easing is expected at the 20 March meeting, and the possibility of a return to negative rates later in 2025 cannot be entirely ruled out.

Source: own illustration

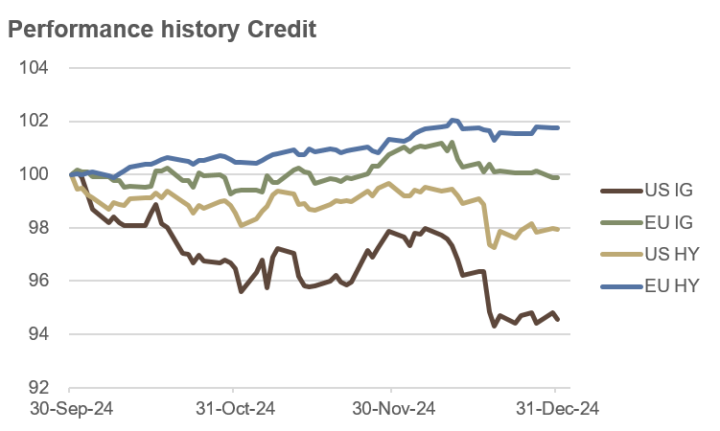

Credit

The rising interest rate environment, particularly in the United States, weighed heavily on US corporate bonds in the 4th quarter. American investment-grade bonds recorded a loss of 5.4%, while US high-yield bonds declined by 2.1%. European markets proved more resilient: investment-grade bonds dipped by just 0.1%, and high-yield bonds gained 1.7%.

High-yield credit spreads narrowed during the quarter, from 3.03% to 2.92% in the US and from 3.42% to 3.11% in Europe. This compression in spreads contributed to high-yield bonds outperforming investment-grade securities on both sides of the Atlantic.

For the full year 2024, results were mixed. US investment-grade bonds posted a loss of 3.5%, while their European counterparts achieved a modest gain of 0.8%. High-yield bonds fared relatively well, rising by 1.6% in the US, though they slipped by 0.3% in Europe.

These divergent movements reflect the characteristics of the asset classes. Investment-grade bonds, which are rated highly for their perceived safety, are more sensitive to changes in interest rates. High-yield bonds, with their speculative ratings, are more closely influenced by equity market dynamics.

The favourable equity market environment in the 4th quarter provided a significant boost to global convertible bonds, which delivered a gain of 6.7% for the period, lifting their annual performance to 13.1%. In contrast, emerging market sovereign bonds struggled under the weight of a strong US dollar and rising interest rates, posting a quarterly decline of 2.0% but still closing the year with a gain of 5.2%.

Source: own illustration

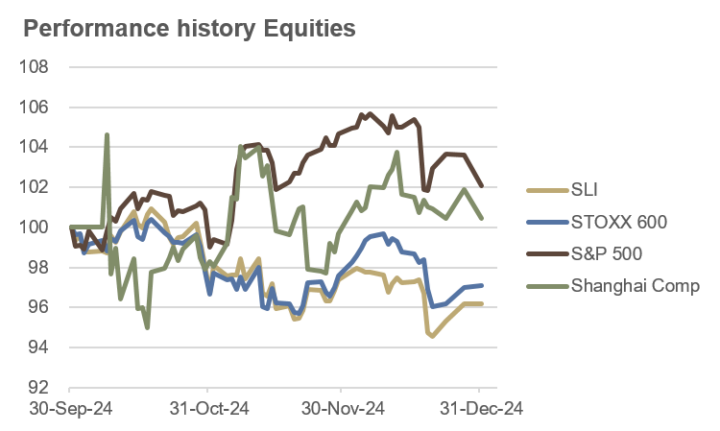

Equities

The US benchmark S&P 500 index continued its upward trend in the 4th quarter, reaching its 57th all-time high of the year on 6 December, at 6,090. However, sentiment was dampened by the Federal Reserve’s rate cut on 18 December, as the central bank signalled a less accommodative monetary policy for 2025. By year-end, the S&P 500 recorded a modest quarterly gain of 2.1%, while the tech-heavy Nasdaq Composite advanced by 6.2%.

In Europe, the 4th quarter proved less favourable. The STOXX 600 declined by 2.9%, and the Swiss Leader Index (SLI) fell by 3.8%, weighed down in particular by Nestlé’s weak performance. The Swiss food giant saw its shares lose over 23% of their value over the year.

Asian markets presented a mixed picture. China’s Shanghai Composite remained volatile throughout the 4th quarter, ending with a modest gain of 0.5%. Meanwhile, Japan’s Nikkei 225 benefited from positive market momentum, rising by 5.2% over the same period.

For the full year 2024, the S&P 500 delivered an impressive gain of 23.3%, with the Nasdaq Composite soaring by 28.6%. A striking feature of the S&P 500’s performance was its concentration: an ETF tracking the 50 largest companies (XLG) surged by 32.4%, while an equal-weighted ETF (RSP), giving each of the 500 constituents a 0.2% weight, rose by only 11.0%.

In Europe, annual gains were more subdued, with the STOXX 600 up 6.0% and the SLI advancing by 7.9%. In Asia, the Shanghai Composite climbed 12.7%, while the Nikkei 225 jumped by 19.2%.

South America saw stark divergences in equity performance. The MSCI Argentina led global markets with a gain of over 130%, while the MSCI Brazil trailed with a loss exceeding 30%.

Source: own illustration

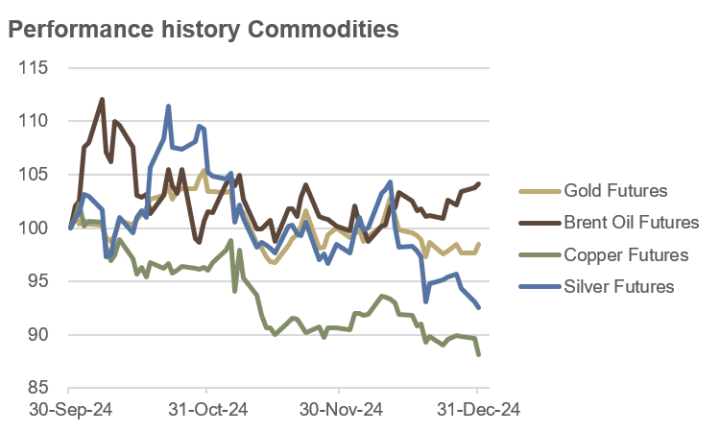

Commodities and Alternative Investments

Gold prices reached a new all-time high of just over $2,800 per ounce at the end of October but failed to maintain this level through year-end. Rising interest rates, particularly in the US, the strength of the US dollar, and Bitcoin’s growing appeal as “digital gold” weighed on prices, resulting in a modest quarterly decline of 1.5%. Nonetheless, gold delivered an impressive annual performance of 27.5%.

Silver, often viewed as a hybrid between a precious and industrial metal, experienced greater volatility. Prices fell by 7.5% in the 4th quarter, reducing its annual gain to 21.7%.

Copper, frequently seen as a barometer of global economic health, disappointed with an 11.8% decline in the 4th quarter but managed to end the year with a modest gain of 3.5%.

Brent crude oil prices recovered toward the end of the year, rising by 4.1% in the 4th quarter. However, crude oil ended the year down 3.1%, remaining below $75 per barrel. Prices were supported by supply-side uncertainties but weighed down by subdued demand outlooks.

The election of Donald Trump as the next US president triggered a significant rally in cryptocurrencies. Bitcoin (BTC/USD) surged by 47% in the 4th quarter, closing the year with an impressive gain of 122%. Ethereum (ETH/USD) posted a more moderate rise, gaining 29% in the 4th quarter and finishing the year up by 47%.

Source: own illustration

Currencies

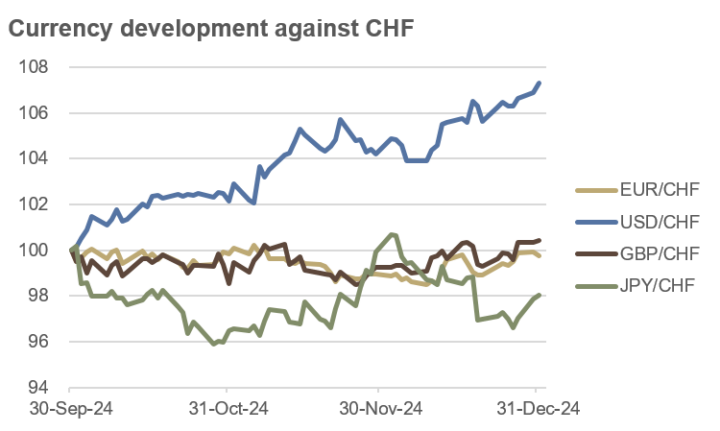

The 4th quarter of 2024 was marked by a strong surge in the US dollar. The Dollar Index (DXY), which measures the value of the USD against six major trading currencies, rose nearly 8% during the quarter, ending the year at 108.49 and delivering a 7.0% annual gain.

The USD/CHF pair climbed by 7.3% in the 4th quarter, closing the year at CHF 0.907, representing a 7.8% annual loss for the Swiss franc. Against the euro, the Swiss franc exhibited greater stability. EUR/CHF ended the year at CHF 0.939, translating to a marginal annual loss of 1.1% for the franc.

The British pound performed strongly against the Swiss franc over the year, with GBP/CHF rising by 6.0% to CHF 1.135, although volatility was limited in the 4th quarter. The Japanese yen showed a more volatile trajectory, posting a 3.3% annual decline against the Swiss franc.

In addition to yen weakness, the year was notable for significant depreciation in many emerging market currencies. The Mexican peso (MXN), Brazilian real (BRL), Russian ruble (RUB), and Turkish lira (TRY) were particularly impacted by the strength of the greenback. Commodity-linked currencies such as the New Zealand dollar (NZD), Australian dollar (AUD), and Canadian dollar (CAD) also suffered substantial losses against “King Dollar”.

Source: own illustration

Outlook

The estimated growth rate for the US economy in the 4th quarter currently stands at 2.4% (Atlanta Fed GDPNow, 3 January 2025). This marks a decline from earlier projections, which consistently exceeded 3% in recent weeks. By comparison, growth in the 3rd quarter was 2.8%, in the 2nd quarter 3.0%, and in the 1st quarter of 2024, 1.6%.

Headline inflation in the US has seen a slight increase since September. The inflation rate rose from 2.4% in September to 2.6% in October and further to 2.7% in November. Current forecasts anticipate rates of 2.86% for December 2024 and 2.89% for January 2025 (Federal Reserve Bank of Cleveland, 3 January 2025).

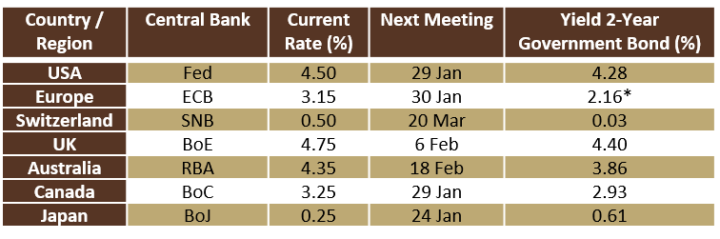

Yields on 2-year government bonds provide critical insights into market expectations regarding the future direction of central bank monetary policy (see table).

Source: own illustration,

as of 3 January 2025.

*Germany

The difference between current key interest rates and the yields on 2-year government bonds indicates expected interest rate cuts in many regions. Particularly in Europe and Switzerland, yields are significantly below their respective key rates, signalling potential future easing. In contrast, Japan’s yield exceeds the key rate, suggesting a possible shift away from ultra-loose monetary policy.

For Q1 2025, we anticipate an initial reflation scenario, with rising growth and inflation rates compared to the previous year. However, the relatively high growth rates of 2.8% to 3.0% in 2024 could pose a significant challenge in the latter part of the year. If inflation remains high in this environment, a stagflation scenario could emerge. Monetarists, however, expect inflation to remain below 2% and foresee a recession in 2025, given weak money supply growth since July 2022. This could lead to a disinflationary scenario with declining growth and inflation rates.

The presidential cycle also suggests muted growth, as the first two years of a term are historically marked by weaker economic performance. The proposed spending cuts by the newly created “Department of Government Efficiency” under Elon Musk could further burden GDP in the short term.

A reflation scenario would initially have a positive effect on risk assets such as equities and commodities. Within the equity market, growth and momentum factors are likely to take center stage, with technology, cyclical consumer goods, industrials, energy, and financial services standing to benefit.

However, investor focus is likely to shift soon toward the emerging signs of a slowdown in economic growth, potentially driving a shift toward more defensive sectors, such as healthcare and non-cyclical consumer goods.

Fixed Income

The expected reflation scenario with rising growth and inflation rates initially weighs on the outlook for long-term bonds. However, market attention is likely to soon shift toward expectations of lower growth rates. In this environment, we consider positioning in the intermediate maturity segment between 5 and 10 years to be prudent.

European bonds may outperform their US counterparts in Q1 2025. We currently assess the risk of bonds from peripheral eurozone countries relative to German and French securities as very low.

To hedge against unexpected inflation shocks, we also continue to maintain a moderate position in inflation-linked bonds.

Credit

We expect credit spreads to widen towards the end of Q1, and therefore prefer investment-grade corporate bonds over high-yield bonds. In emerging market debt, we remain cautious, as the strong US dollar could exert additional pressure on these markets.

In the credit space, we focus on liquid bonds and maintain a cautious stance on structured credit products, as well as in the areas of private credit and private debt.

Equities

For Q1 2025, we initially expect a reflationary scenario with rising economic growth and inflation, which should support risk assets like equities. In this environment, sectors such as technology, industrials, financial services, energy, and discretionary consumer goods are expected to benefit, with growth and momentum factors playing a significant role. The current trends in major equity markets remain positive.

However, as the quarter progresses, investor focus is likely to shift towards an anticipated slowdown in growth. In light of this, a gradual shift towards more defensive sectors such as consumer staples, healthcare, and utilities appears sensible.

Europe could potentially surprise positively compared to the US for the first time in a while. On the other hand, we remain cautiously positioned in emerging market equities for the time being.

Commodities and Alternative Investments

January has historically been the strongest month for gold price performance since 1971. After an impressive gain of over 27% in 2024, however, the announced tighter monetary policy from the Federal Reserve, along with a strong US dollar, could present significant hurdles for further price increases. A key support level currently stands at $2,616 per ounce. Nevertheless, we see medium-term upside potential and maintain a strategic positioning in gold.

In Q1, copper prices may surprise positively, despite the current bearish trend. This sentiment is also reflected in the futures market positioning, which is currently marked by a notably negative stance – often interpreted as a contrarian indicator.

In the oil market, a trend reversal has been observed recently. The positive trend is expected to persist in the short term, not so much due to sharply rising global demand, but rather as a result of supply-side disruptions. In the medium term, however, the new US administration under the “Drill Baby, Drill” slogan may lead to an expansion of North American oil supply, potentially putting downward pressure on prices

Currencies

In Q1 2025, the EUR/CHF currency pair could rise. The current positioning in the futures market shows a distinctly negative stance towards the euro and a slightly positive one towards the Swiss franc – an indicator often interpreted as contrarian. Furthermore, expectations for rate cuts in Europe are high, while the macroeconomic and political environment is perceived as very weak. Even a modest positive surprise could give the euro a boost. The GBP/CHF could also rise, although to a more moderate extent.

The strength of the US dollar is expected to persist initially but may lose momentum after Donald Trump’s inauguration.

A long position in the Japanese yen appears attractive, as further interest rate hikes in Japan should provide support for the JPY. This is particularly significant because the rate hike in early August 2024 triggered considerable turbulence in global financial markets, while the yen appreciated sharply within days.

Conclusion

At the outset of Q1 2025, we anticipate a reflationary scenario characterised by rising inflation and growth rates, creating initially favourable conditions for risk assets such as equities and commodities. However, as the quarter progresses, investor attention is likely to shift towards expectations of slowing growth. Contributing factors include the persistently weak growth in the money supply since July 2022, the presidential cycle which typically sees subdued growth in the first two years of a term, and the planned spending cuts by the US government under the newly established “Department of Government Efficiency” (DOGE) headed by Elon Musk. In this context, we consider a gradual rotation towards defensive assets to be prudent.

In the bond market, we are focusing on intermediate maturities of 5 to 10 years. These offer an attractive balance between reinvestment risk at the short end and limited additional yields that would typically offset duration risk at the long end. In the credit space, we favour investment-grade bonds over high-yield debt.

In equities, we plan a gradual shift towards defensive sectors such as consumer staples, healthcare, and utilities. Europe and Switzerland may outperform the US, as the potential for rate cuts in these regions appears stronger.

In the commodity market, we expect initial positive developments in oil and copper. For gold, while short-term challenges exist due to rising interest rates and a strong US dollar, we remain strategically positioned for the long term, aiming to provide portfolio protection.

On the currency front, we find exposure to USD and JPY appealing, as both currencies are likely to strengthen during periods of heightened market turbulence. Additionally, we are implementing liquid trend-following strategies, which, due to their low or even negative correlation with other asset classes, can help mitigate portfolio volatility.