Quarterly Outlook Q2 2025

Change brings uncertainty but also new investment opportunities.

Review

Fixed Income

Yields on 10-year US Treasury bonds eased in the 1st quarter to 4.22%, down from 4.57% at the end of 2024. They had peaked at just under 4.80% in early January. The decline in long-term yields lifted the iShares 20+ Year Treasury Bond ETF (TLT) by 3.2%. Shorter-dated yields followed suit, with two-year Treasury yields falling from 4.24% to 3.89% over the same period, leaving the yield curve spread between 10-year and 2-year bonds broadly unchanged at 33 basis points. The Federal Reserve held interest rates steady at 4.50% throughout the 1st quarter. Its upcoming meetings are scheduled for May 7 and June 18, with markets anticipating the first rate cut no sooner than June.

In contrast, long-term yields in the eurozone moved higher. German 10-year Bund yields rose nearly 40 basis points to 2.73% (from 2.36% at end-2024), while their Italian counterparts climbed to 3.86% from 3.52%. The European Central Bank lowered its main refinancing rate from 3.15% to 2.65% during the quarter. Further rate cuts are widely expected at its upcoming meetings on April 17 and June 5.

UK gilt yields also edged higher, albeit less markedly than in the eurozone. Ten-year gilt yields rose from 4.57% at the beginning of the year to 4.68% by the quarter’s close. The Bank of England cut its policy rate from 4.75% to 4.50% over the quarter and is expected to deliver another rate cut at its May 8 meeting.

In Japan, 10-year government bond yields reached their highest level since 2008, ending the quarter at 1.47%, up from 1.07% at the start of the year. The Bank of Japan raised interest rates from 0.25% to 0.50%, with its next policy meeting set for May 1. Analysts anticipate further tightening later in the year.

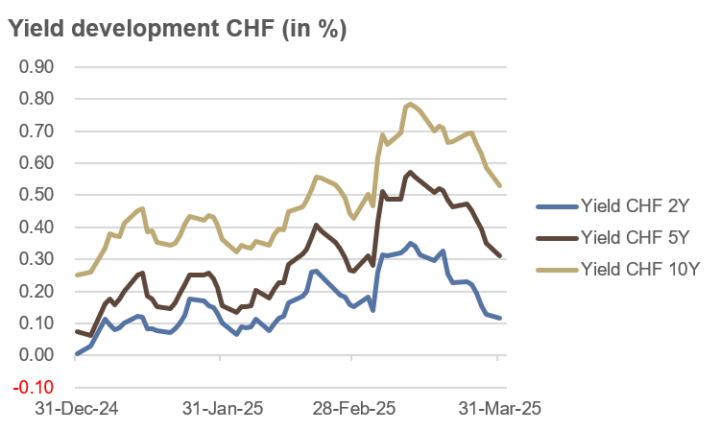

Swiss yields followed a similar trajectory to Germany’s but remained at significantly lower levels. The yield on 10-year Confederation bonds climbed from 0.25% at end-2024 to a mid-March high of 0.78%, before closing the quarter at 0.53%. The Swiss National Bank cut its policy rate from 0.50% to 0.25% at its March 20 meeting. The next monetary policy meeting is scheduled for June 19, though further rate cuts are not currently expected.

Source: own illustration

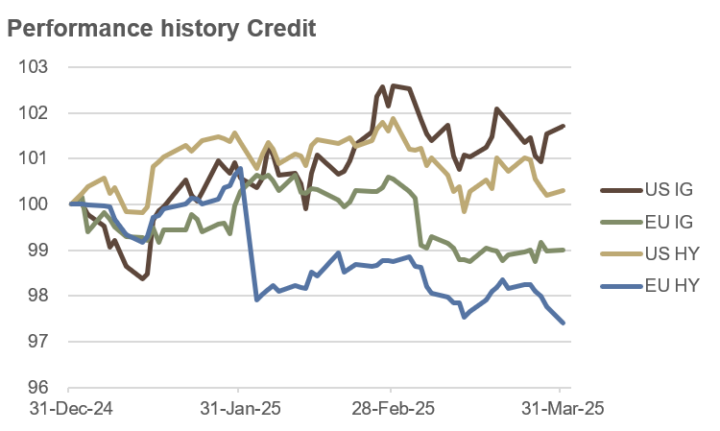

Credit

Diverging interest rate trends in the US and Europe had differing effects on corporate bonds. US investment-grade bonds were the standout performers, benefiting from declining yields and gaining 1.7% over the first three months of the year. US high-yield bonds, however, saw more limited gains as credit spreads widened from 2.92% to 3.55%, resulting in a modest 0.3% increase.

European corporate bonds faced dual headwinds: rising interest rates and widening credit spreads, which moved from 3.11% to 3.28%. This led to negative returns of -1.0% for European investment-grade bonds and -2.6% for high-yield debt.

These divergent moves reflect the differing characteristics of asset classes. Investment-grade bonds, deemed safer by rating agencies, are highly sensitive to shifts in interest rates, whereas high-yield bonds, considered more speculative, exhibit a stronger correlation with equity markets.

Volatility in US equities weighed on the performance of global convertible bonds, which ended the 1st quarter down 1.5%. In contrast, emerging-market sovereign bonds denominated in US dollars benefited from a weaker greenback, delivering a 1.4% gain over the quarter.

Source: own illustration

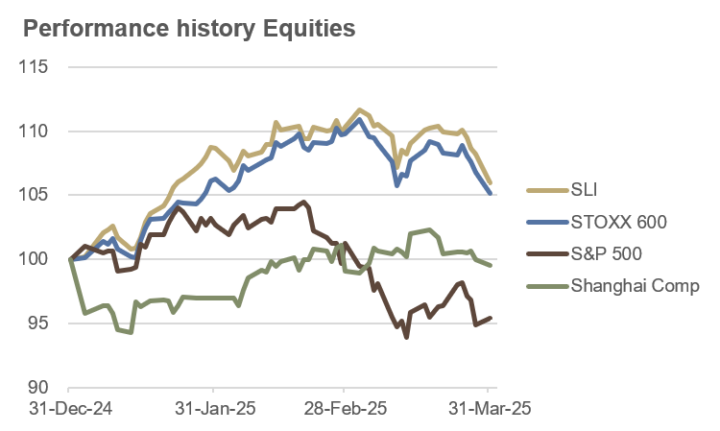

Equities

The US equity market lagged behind the rest of the world in the 1st quarter. While the S&P 500 reached a record high of 6,144 points on February 19, it subsequently fell into a correction of more than 10%, hitting a cyclical low of 5,521 points on March 13. By the end of the quarter, the index had declined 4.6% – its worst quarterly performance since Q3 2022. The tech-heavy Nasdaq Composite fared even worse, sliding 10.4%. High-valuation technology stocks bore the brunt of the sell-off, whereas an equal-weighted ETF, which assigns each of the S&P 500’s 500 constituents a 0.2% weighting, fell by just 1.1%.

European equity markets proved far more resilient. The pan-European STOXX 600 gained 5.2% over the quarter, buoyed by strong demand for stocks in the defense and banking sectors. Switzerland’s more defensive Swiss Leader Index (SLI), led by heavyweights such as Nestlé, climbed 6.0%.

In Asia, the Shanghai Composite edged down 0.5% in the 1st quarter, while Hong Kong’s Hang Seng Index surged more than 15%. Japan’s Nikkei 225, by contrast, lost 8.9%.

Latin American equity markets also saw robust gains in Q1, with strong performances from Colombia, Chile, and Brazil.

Source: own illustration

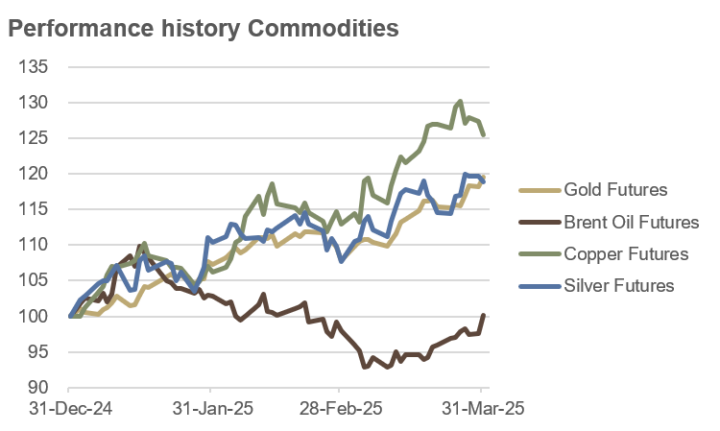

Commodities

Gold ended the 1st quarter at a record high of $3,150 per ounce, surging nearly 20% over the period – its strongest quarterly performance since 1986. Silver followed a similar trajectory, rising almost 20%.

Copper posted even stronger gains, climbing more than 25% in Q1 and reaching an all-time high in late March before paring some of its advance.

Brent crude traded within a relatively stable range of $69 to $82 per barrel, ending the quarter largely unchanged at just under $75. A key technical support level at $69 remained intact.

The initial euphoria in cryptocurrency markets following Donald Trump’s election as US president faded over the quarter. Bitcoin (BTC/USD) lost 12% in Q1, while Ether (ETH/USD) tumbled 45%.

Source: own illustration

Currencies

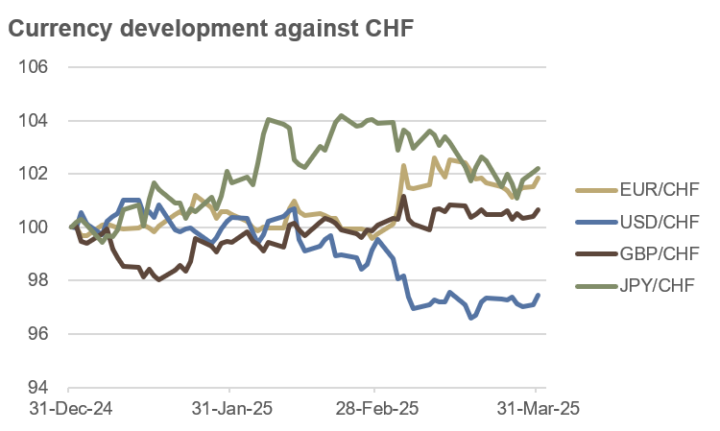

The US dollar’s upward trajectory reversed following Donald Trump’s inauguration as US president. The Dollar Index (DXY), which measures the greenback against a basket of six major trading partners, declined 4% over the quarter, after rising 7% in 2024, ending March at 104.18.

The USD/CHF currency pair fell 2.5% in Q1, closing at CHF 0.884, down from CHF 0.907 at year-end. In contrast, the euro strengthened 1.8% against the Swiss franc, moving from CHF 0.939 to CHF 0.957. Sterling also gained against the franc, albeit more modestly, rising just 0.6%.

The Japanese yen appreciated 2.2% versus the Swiss franc over the first three months of the year.

Source: own illustration

Outlook

On April 2 – dubbed “Liberation Day” by President Donald Trump – the US administration is expected to announce sweeping measures on new import tariffs. Uncertainty over the scale and scope of these tariffs has already left a noticeable mark on growth expectations. According to the latest estimate from the Atlanta Fed’s GDPNow model (April 1, 2025), the US economy is projected to contract by 3.7% in the 1st quarter. Even when adjusted for gold imports and exports, growth remains firmly in negative territory at -1.4%. Betting platform Kalshi (Source: https://kalshi.com/markets/kxrecssnber/recession, 2 April 2025) assigns a 44% probability to a US recession in 2025, defining a recession as two consecutive quarters of negative GDP growth.

US headline inflation remained between 2.8% and 3.0% in the 1st quarter, well above the Federal Reserve’s 2% target. The latest estimates for March and April, published with a one-month lag, stand at 2.49% and 2.54%, respectively (Federal Reserve Bank of Cleveland, April 2, 2025).

This backdrop, coupled with uncertainty surrounding the potential economic impact of new tariffs, is likely to complicate the Federal Reserve’s ability to ease monetary policy in the coming months.

In contrast, inflation in Europe has edged closer to the European Central Bank’s 2% target, though at 2.2%, it remains marginally above.

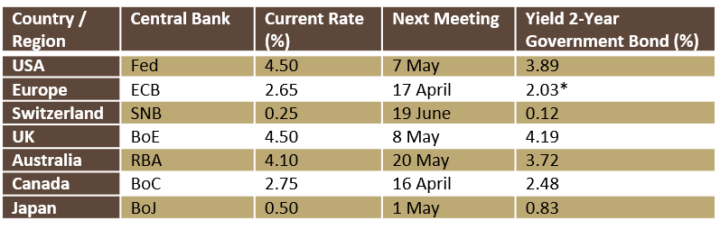

The yield on two-year government bonds continues to serve as a key gauge of market expectations regarding future central bank policy direction (see table).

Source: own illustration

as of 31 March 2025

*Germany

The gap between current policy rates and two-year government bond yields suggests that markets are pricing in two to three rate cuts (each of 25 basis points) in most major economies this year. In Switzerland, however, no further rate adjustments are expected, while Japan could even see another rate hike before year-end.

For the 2nd quarter, we anticipate a disinflationary scenario, with slowing growth and lower inflation compared to the previous year. However, should the decline in inflation stall as the quarter progresses, a stagflationary outcome – marked by slowing growth alongside rising inflation – remains a possibility.

In a disinflationary environment, bonds and gold, as well as defensive equity sectors such as consumer staples, healthcare, and utilities, tend to outperform. Among equity factors, low-beta stocks, high-dividend yield plays, quality, and value are likely to be favored.

Fixed Income

The anticipated disinflationary backdrop in the 2nd quarter provides a favorable environment for high-quality sovereign bonds. We see particular value in the mid-range maturities of five to ten years.

Within the eurozone, the ongoing fiscal integration could make peripheral bonds particularly appealing, as they continue to offer a yield premium over German Bunds.

To hedge against unexpected inflation shocks, we maintain a moderate allocation to inflation-linked bonds.

Credit

We favor investment-grade corporate bonds over high-yield debt, as credit spreads are likely to widen further over the course of the 2nd quarter. Investors seeking higher yields may find opportunities in emerging market bonds, which could benefit particularly from a weaker US dollar.

We remain cautious on structured credit products as well as private credit and private debt investments, given the anticipated deterioration in market liquidity in these segments of the credit market.

Equities

We expect a disinflationary scenario in the 2nd quarter, with declining growth and inflation rates, which could weigh on risk assets like equities.

Seasonally, April marks the final month of the traditionally strongest market phase from November to April. However, seasonal patterns have played a lesser role in the current cycle, making fundamental factors more decisive. Against this backdrop, we plan to moderately reduce equity exposure in April during periods of market strength.

In the current environment, defensive sectors such as consumer staples, healthcare, and utilities should benefit. We see particular appeal in stocks with low beta, high dividend yields, and strong quality and value characteristics.

Our regional preferences remain unchanged: we favor European equities over US stocks. Additionally, we are increasingly turning our attention to Latin American equities, supported by a weaker US dollar in Q2 and the potential for rate cuts in these high-interest markets.

Commodities

Gold reached a new all-time high of $3,150 per ounce at the end of Q1. We expect further price increases and maintain our strategic positioning. In contrast, we remain more cautious on silver.

Copper also hit a record high in Q1. However, market sentiment has improved, and previously bearish positioning has been unwound. Given a weakening global growth outlook, we anticipate lower copper prices in Q2.

On the other hand, we expect crude oil prices to trend higher. Current market positioning is extremely negative, leaving room for a rebound. However, given economic cooling, any price increase is likely to stem from supply-side disruptions rather than surging demand.

Agricultural commodities are set to perform particularly well in Q2, with wheat, cotton, coffee, cocoa, and orange juice standing out.

Currencies

We expect the Swiss franc to strengthen in Q2. Futures market positioning is predominantly negative – a classic contrarian indicator. Additionally, the Swiss National Bank is likely to be more cautious with rate cuts than other central banks, which are expected to ease further in the coming months.

The recent weakness of the US dollar may stabilize in the short term. However, we anticipate renewed depreciation later in the quarter as US economic growth slows more than currently priced in by the market.

Mid-term, we expect a stronger Japanese yen as the Bank of Japan is likely to raise interest rates later this year. A JPY position also adds stability to a balanced portfolio, as periods of increased financial market turbulence typically coincide with yen appreciation.

Given the predominantly negative futures market positioning, the New Zealand dollar and Australian dollar could positively surprise in Q2.

Conclusion

Uncertainty surrounding the scope and impact of new US import tariffs is likely to weigh on markets for the foreseeable future. It is becoming increasingly clear that the era of highly globalised supply chains has peaked, with a shift towards greater onshoring of production appearing more probable.

This uncertainty is expected to lead to declining growth and inflation rates in the coming months. Against this backdrop, we are focusing on bonds with medium-term maturities of five to ten years. To hedge against potential inflation shocks, we maintain a modest allocation to inflation-linked securities. In credit markets, we favour investment-grade corporate bonds over high-yield debt, as credit spreads are likely to widen in the months ahead.

In equities, we prioritise defensive sectors such as consumer staples, healthcare, and utilities. Regionally, we prefer European and Swiss stocks over US counterparts. Additionally, a selective allocation to Latin American equities appears attractive.

As a strategic hedge within our portfolio, we maintain a substantial allocation to gold. Meanwhile, oil prices are expected to rise further in the coming months amid tightening global supply.

In foreign exchange markets, the Swiss franc could strengthen in response to heightened geopolitical tensions. Moreover, the Swiss National Bank is likely to remain more cautious on rate cuts compared to other central banks, which still have room for monetary easing.