Quarterly Outlook Q3 2024

Economic slowdown and falling inflation rates

Review

Fixed Income

In the second quarter, the yields on ten-year US Treasury bonds saw a slight increase from 4.21% at the end of March to 4.39% by the end of the quarter. Throughout the quarter, they fluctuated within a range of approximately 4.2% to 4.7%. This moderate rise in long-term US interest rates led to a 3.0% decline in the price of the closely watched iShares 20+ Year Treasury Bond ETF (TLT) in Q2. Yields on two-year US bonds also edged up slightly, from 4.63% to 4.75%. The Federal Reserve kept the policy rates unchanged at 5.50% during the quarter. Meanwhile, market participants anticipated one to two rate cuts for the remainder of the year. The next Fed meetings are scheduled for July 31, September 18, November 7, and December 18. Additionally, the annual gathering of major central banks in Jackson Hole will take place from August 22 to 24.

In the Eurozone, long-term yields also rose: German 10-year Bunds increased from 2.29% to 2.49%, and Italian bonds from 3.67% to 4.08%. This widened the yield spread from under 140 basis points (bps) to nearly 160 bps. However, particular attention was given to French government bonds, whose yields increased from 2.80% to 3.30% towards the end of the quarter due to political concerns. The European Central Bank (ECB) cut interest rates by 25 bps during Q2, from 4.50% to 4.25%. Despite this rate cut, the yields on two-year German bonds ended the quarter virtually unchanged compared to the end of March at 2.83%. The next ECB meetings are on July 18 and September 12.

The global synchronisation of long-term interest rates – often compared to the behaviour of a school of fish – was confirmed in the United Kingdom with a rise in the yield on 10-year Gilts from 3.98% to 4.21%. The Bank of England kept interest rates steady at 5.25% but indicated a potential rate cut at one of its upcoming meetings. The next meetings are on August 1 and September 19.

In Japan, yields on 10-year JGB bonds rose over the quarter from 0.73% to 1.03%. Meanwhile, policy rates remained unchanged at 0.10%. The next Bank of Japan meeting is on July 31.

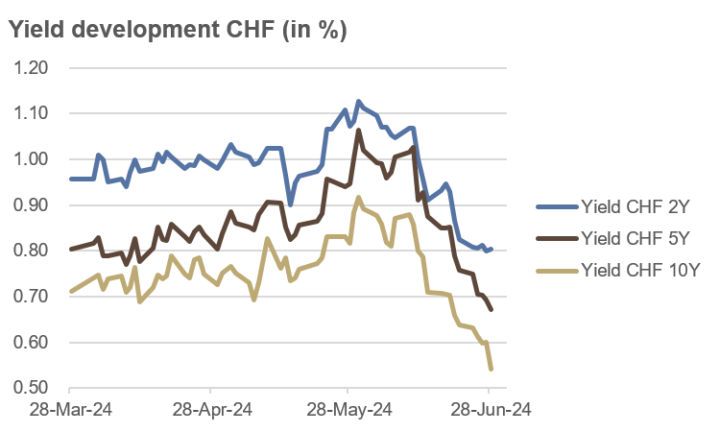

Contrary to the rise in global interest rates, yields across the Swiss yield curve fell. At the end of the quarter, the yield on the 10-year “Eidgenoss” bond was 0.54%, five-year bonds yielded 0.67%, and two-year bonds stood at 0.80%. At its June 20 meeting, the Swiss National Bank (SNB) unexpectedly cut interest rates for the second time this year, from 1.50% to 1.25%. The next meeting is on September 26, the last under the leadership of SNB Chairman Thomas Jordan.

Source: own illustration

Credit

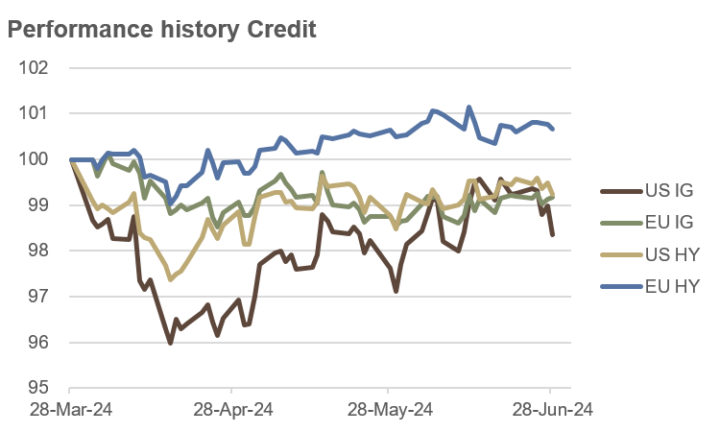

Rising interest rates exerted some downward pressure on European and US corporate bond prices in the second quarter. In the high-yield bond sector, US credit spreads saw a slight increase, rising from 3.15% to 3.21% by the end of the quarter, while European high-yield bond spreads narrowed slightly, from 3.52% to 3.49%. As a result, European high-yield bonds posted a small price gain, whereas European and American investment-grade bonds, as well as US high-yield bonds, showed small price declines.

Investment-grade bonds are the highest-quality bonds as rated by credit rating agencies, whereas high-yield bonds are more speculative and have a rating below investment grade. The prices of high-yield bonds tend to react similarly to stock markets, while investment-grade bond prices are more influenced by overall interest rate levels.

The rather positive market environment – also referred to as a “risk-on” environment – was only partially reflected in the performance of convertible bonds and emerging market sovereign bonds in Q2. While convertible bonds ended the quarter with a modest gain of 0.6%, emerging market sovereign bonds in USD lost 0.1%.

Source: own illustration

Equities

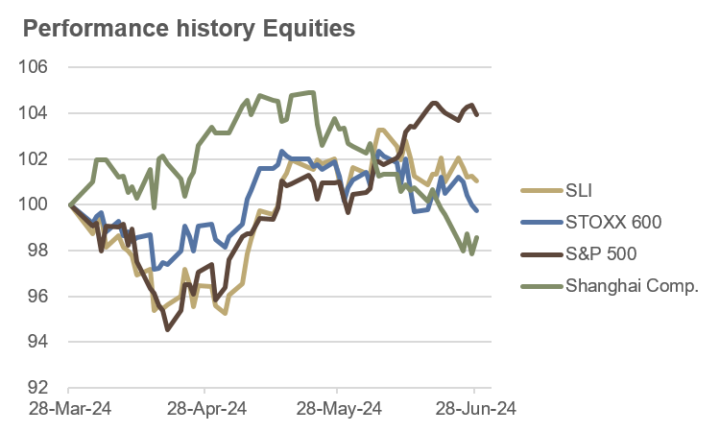

After a rocky start to the second quarter and losses in April, European and American stock markets rebounded and continued their ascent. However, in the final weeks of June, momentum slowed, especially in Europe, due to the unexpectedly announced snap elections in France. In the US, the S&P 500 rose by 3.9% to a new all-time high of 5,487, ending the quarter with a year-to-date gain of 14.5%. The tech-heavy Nasdaq Composite advanced even further, up 18.1% over the same period.

In Europe, the STOXX 600 was unable to maintain its gains, finishing the quarter with a slight decline of 0.2%. Nevertheless, it still posted a year-to-date increase of 6.8%. In Switzerland, the Swiss Leader Index (SLI) rose by 1.0% in the second quarter and was up 9.4% year-to-date.

Economic troubles in China were once again felt in the stock market during the second quarter. The Shanghai Composite lost 1.4% in Q2, registering a year-to-date decline of 0.3%. Japanese stock markets were also increasingly affected, with the Nikkei 225 recording a quarterly loss of 2.0%. However, the Japanese index still boasted an 18.2% year-to-date gain.

The MSCI World index increased by 10.8% year-to-date. The best stock market performances in the first six months were seen in Turkey, Taiwan, and Pakistan, while Mexico, Thailand, and Brazil were at the bottom.

In this environment, our Palatium equity funds also performed exceptionally well. Year-to-date, the Swiss Equities PLUS R fund rose by 10.0%, the European Equities PLUS R fund increased by 10.4%, and the North American Equities PLUS R fund advanced by 12.7%.

Source: own illustration

Commodities and Alternative Investments

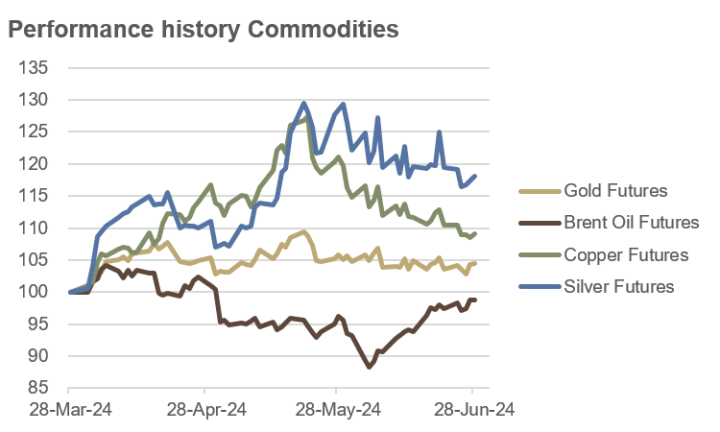

The price movement in silver contracts was particularly volatile in the second quarter. The price per ounce rose from $25 to over $32, ending the quarter at $29. This represents an 18% increase for the quarter and a year-to-date performance of 23%.

Copper contracts also saw gains, rising to over $5 per pound by mid-May, though they were unable to maintain this level, ending the quarter at $4.37. The quarterly performance was 9%, with prices climbing 12% year-to-date.

Conversely, crude oil prices fell by over 10% to $77 per barrel (Brent Crude) by early June. Due to new geopolitical tensions in the Middle East, the price rebounded to $86 by the end of the quarter, resulting in a slight quarterly decline of 1.2%.

Gold prices reached a new all-time high of $2,450 per ounce in May and increased by 4.4% during the quarter. Year-to-date, the yellow metal posted a gain of 12.8%.

Cryptocurrencies reported a setback in the second quarter. BTC/USD fell by 13%, and ETH/USD lost 4%. However, Bitcoin still showed a year-to-date gain of 43%, while Ether increased by 48%.

Source: own illustration

Currencies

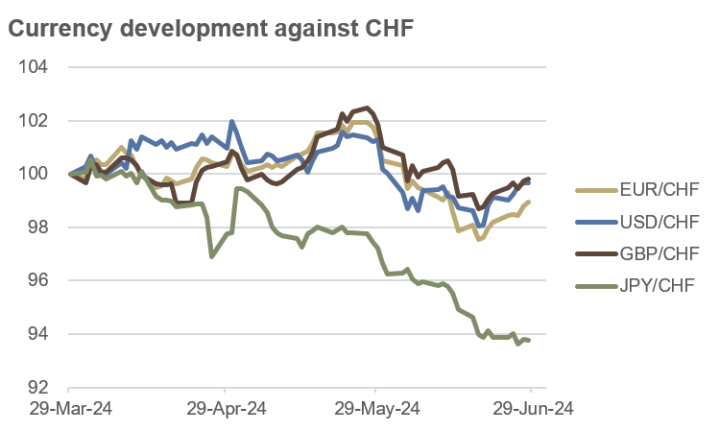

Despite an increase towards the end of the quarter, the major trading currencies lost some ground against the CHF over the past three months. The similar performance of the USD, EUR, and GBP against the CHF was particularly notable. By the end of May, these three currencies had appreciated by nearly 2% against the CHF. However, the CHF began to strengthen as market participants increasingly believed that the SNB would not lower interest rates as expected. Additionally, rising political uncertainties in Europe led to a flight to the CHF. Following the unexpected rate cut by the SNB on June 20, the USD, EUR, and GBP began to appreciate again.

As a result, the USD/CHF declined by 0.3%, from 0.902 to 0.899. The EUR/CHF fell by 1.1%, from 0.973 to 0.963, while the GBP/CHF lost 0.2%, from 1.138 to 1.136.

The JPY had a different trajectory, continuously depreciating against the CHF and ending the second quarter with a loss of over 6%.

The Dollar Index (DXY or, informally, the “Dixie”), which measures the value of the USD against a basket of six different currencies, continued its positive trend in the second quarter with an increase of 1.3%.

Source: own illustration

Outlook

In the second quarter, positive economic growth of +1.7% is expected in the US (Atlanta Fed GDPNow, July 1, 2024), following +1.4% in the first quarter. However, estimates have been slightly revised downward in recent weeks. Inflation figures have also decreased in recent months but remain well above the 2% target rate. Most market observers anticipate one or two rate cuts by the Federal Reserve for the remainder of the year.

Several central banks began cutting rates in the second quarter, including the ECB and the Bank of Canada. In Switzerland, the SNB continued its rate-cutting cycle with a second reduction of 0.25%, bringing the rate down to 1.25%. We expect the SNB to implement another cut before the end of the year. Additionally, we anticipate a first rate cut by the Bank of England in August. After a brief pause of 1-2 meetings, the ECB is likely to follow with further cuts. We expect the US Federal Reserve to make its first rate cut in September.

The trend towards lower policy rates can be rationally attributed to a global economic slowdown and declining inflation rates. However, we do not foresee a worldwide recession, but rather a slight decrease in global economic growth.

In this disinflationary scenario – characterized by both declining growth and inflation rates – bonds, gold, and the US dollar are expected to perform particularly well. This scenario, which we anticipate in the third quarter, should also favour some more defensive equity sectors.

Fixed Income

Lower expected growth and inflation rates and the resulting policy rate cuts by central banks in the third quarter are bullish for high-quality long-term bonds and should lead to declining long-term interest rates. However, a potentially disruptive factor could be extremely expansive fiscal policies financed by a high volume of new government bonds. If this additional supply meets unchanged demand, bond prices could fall, causing yields to rise.

We believe that the debt crisis surrounding Liz Truss’ mini-budget in the United Kingdom in October 2022 highlighted to policymakers the critical importance of a functioning bond market, and that such a scenario is unlikely to recur in the medium term.

Therefore, we remain positioned in long-term government bonds, also to hedge against potential market turbulence. Extending the duration makes sense to minimize reinvestment risk.

We continue to maintain a slight underweight position in inflation-protected bonds, as we expect “inflation surprises” to be more likely on the downside rather than the upside.

Credit

In the third quarter, while we do not foresee a global recession, we anticipate a moderate economic slowdown. Consequently, the compression of credit spreads for high-yield bonds is unlikely to continue. Therefore, we favour investment-grade bonds over high-yield bonds.

Regarding real estate financing bonds – particularly those tied to commercial properties – we remain extremely cautious. The phrase “extend and pretend” is gaining traction, and it seems only a matter of time before the first valuation corrections will need to occur.

Equities

Following strong stock performance in the first half of the year, we see the risk of pullbacks increasing. While anticipated interest rate cuts provide positive momentum, the expected economic slowdown may dampen earnings growth.

In the third quarter’s anticipated disinflationary environment, we favour stocks in utilities, consumer staples, healthcare, and big-cap tech sectors.

Our preferred style factors are quality and minimum volatility.

The boom in Artificial Intelligence (AI) is expected to continue, reinforcing the importance of large-capitalization US tech stocks.

Given escalating economic and political challenges in China, we maintain a cautious approach toward investments with significant “China exposure”.

Commodities

Despite expectations of a rising US dollar, we anticipate an increase in the price of gold. While net long positions in the futures market are already relatively high, indicating that many market participants anticipate higher prices, we maintain a significant strategic position to hedge against potential market turbulence.

Although silver exhibits similar portfolio characteristics to gold, we remain cautious due to its high price volatility and the current very bullish market positioning.

The copper price is likely to continue its recent downward trend. While market positioning is highly bullish, challenges in China appear greater than anticipated by many participants.

We expect crude oil prices to remain at current levels in the third quarter. Demand is not expected to rise significantly due to the anticipated economic slowdown, but geopolitical tensions and conflicts may limit supply. Net long positions are only marginally higher than the long-term average, providing no clear signal at present.

In agricultural commodities, the price outlook appears particularly favourable for cotton, sugar, and cocoa at the moment.

Currencies

In currency markets, alongside the USD, the CAD and CHF could also surprise positively. Both the Loonie (CAD) and the Swissie (CHF) currently exhibit historically high net short positions in the futures market, which in the past has often led to significant counter-reactions. Similarly, positioning in the JPY is extremely negative, suggesting potential for a positive surprise.

Conversely, positioning in the NZD, MXN, and GBP is currently bullish, leading us to anticipate pullbacks in these currencies during the third quarter.

For diversification and portfolio hedging purposes, we maintain our strategic positioning in USD.

Conclusion

The future remains uncertain. No one knows what lies ahead.

In sports, the most critical games are often lost not due to winning strategies but because of significant errors. This analogy holds true in investing as well. The key is to avoid major mistakes rather than chasing the hottest stock tips. Therefore, we maintain a structural diversification to prepare for various future scenarios.

Our primary scenario for the third quarter anticipates declining growth and inflation rates. However, we also prepare for a stagflation scenario characterized by sluggish growth and persistently high inflation rates.

Regarding monetary policy from major central banks, we anticipate interest rate cuts throughout the third quarter, notably expecting the Federal Reserve’s first rate cut in September. We consider a positioning in long-term government bonds prudent to minimize reinvestment risk and hedge against an economic downturn. Additionally, we maintain a significant strategic position in gold.

In equities, we increasingly favour defensive sectors while continuing to hold large-cap US tech stocks, as the momentum around Artificial Intelligence is expected to persist.

To further diversify, we hold trend-following funds designed to mitigate portfolio volatility through low or even negative correlations with other asset classes.