Quarterly Outlook Q4 2024

Interest rate cuts are leading to new all-time highs and increased market volatility. Are these records sustainable in the long term, or is an impending recession looming?

Review

Fixed Income

In the 3rd quarter, yields on 10-year US Treasury bonds saw a steady decline. Yields peaked at 4.46% on July 1 before bottoming out at 3.62% on September 16, ending the quarter at 3.79%. Notably, long-term yields edged up slightly after the Federal Reserve’s rate cut on September 18. The overall drop in rates drove a 6.9% price increase in the iShares 20+ Year Treasury Bond ETF (TLT) over the quarter. Yields on two-year bonds also fell, from 4.75% to 3.65%, leading to a partial normalisation of the yield curve by late September. Following a 0.50% cut in the federal funds rate to 5.00%, markets anticipated two to three more 0.25% cuts by year-end. The Fed’s upcoming meetings are scheduled for November 7 and December 18.

In the Eurozone, 10-year German Bund yields followed a similar trajectory, declining from 2.61% on July 1 to 2.14% by the end of September. Italian 10-year yields dropped even more sharply, from 4.11% to 3.46%. Interestingly, towards the end of the quarter, French bonds briefly offered higher yields than their Spanish counterparts. The European Central Bank cut rates again in Q3, with market participants beginning to price in an additional October cut on top of the expected December reduction. The ECB’s next meetings are slated for October 17 and December 12.

In the UK, the decline in 10-year gilt yields was more modest, from 4.29% to 3.98%. Expectations for the Bank of England (BoE) remained muted, with a potential 0.25% cut anticipated by year-end. The BoE is due to meet on November 7.

Japanese 10-year JGB yields fell from 1.06% to 0.86% over the quarter. The Bank of Japan’s (BoJ) rate hike on July 31 to 0.25% caused global market volatility, with further hikes no longer expected this year. The BoJ’s next meeting is set for October 31.

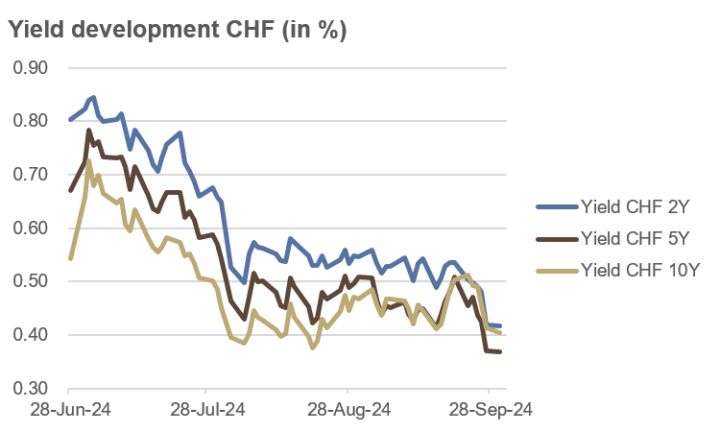

In Switzerland, yields across the curve declined. Swiss 10-year bonds yielded 0.41% by the quarter’s end, five-year bonds 0.37%, and two-year bonds 0.42%. The Swiss National Bank (SNB) cut its policy rate for the third time this year on September 26, from 1.25% to 1.00%, and hinted at further cuts. The final SNB meeting of the year, the first under Martin Schlegel’s leadership, is scheduled for December 12.

Source: own illustration

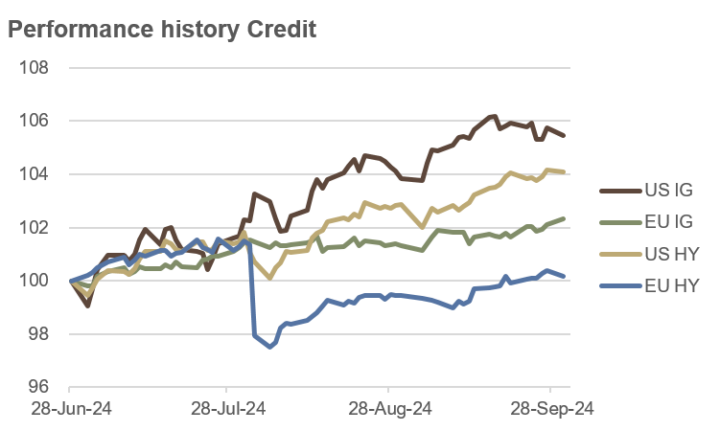

Credit

The decline in interest rates boosted corporate bond prices. US investment-grade bonds posted a strong quarterly gain of 5.5%, followed by US high-yield bonds, which rose 4.1%. In Europe, the increase was more moderate: investment-grade bonds advanced 2.3%, while European high-yield bonds barely stayed in positive territory with a modest 0.2% gain. Market turbulence, particularly in early August, weighed heavily on the performance of high-yield bonds, especially in Europe. This was also reflected in credit spreads. Spreads on European high-yield bonds widened from 3.48% to a peak of 4.02% in early August before ending the quarter at 3.42%. In the US, spreads rose from 3.18% to 3.93% before closing the quarter at 3.03%.

Investment-grade bonds are rated among the highest by credit rating agencies, while high-yield bonds are considered more speculative, with ratings below investment grade. The prices of high-yield bonds tend to behave similarly to equity markets, while investment-grade bonds are more sensitive to overall interest rate levels.

The favourable market environment in the 3rd quarter was also evident in convertible and emerging market bonds. Global convertibles rose by 1.0%, while emerging market sovereign bonds denominated in USD gained 5.9%, continuing the established pattern of falling US dollar and global interest rates benefiting emerging markets securities.

Source: own illustration

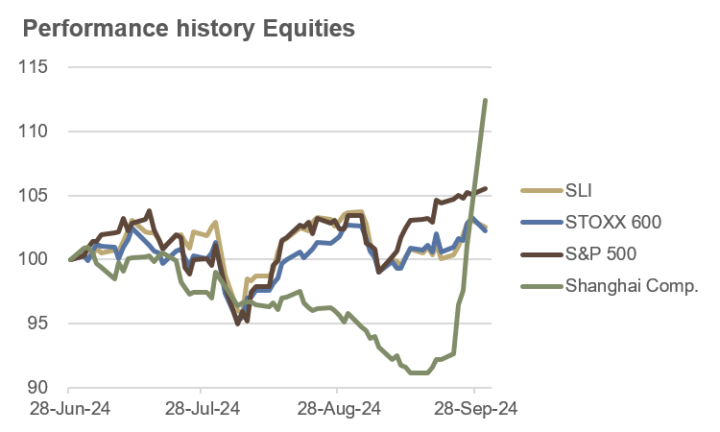

Equities

Major equity markets ended the 3rd quarter with solid gains, despite periods of heightened volatility. Markets came under pressure in early August when the Bank of Japan unexpectedly raised its key interest rate to 0.25%. In the US, the S&P 500 fell 8.5% in just a few days, while the volatility index (VIX) briefly spiked above 65 intraday. Early September saw renewed market turbulence, but the US Federal Reserve’s 0.50% rate cut on September 18 paved the way for a continued rally. The S&P 500 reached a new all-time high of 5,762 at the end of the quarter, marking a 5.5% rise since June and a year-to-date gain of 20.8%.

In Europe, equity markets saw more muted growth. The STOXX 600 gained 2.2% over the quarter, bringing its year-to-date increase to 9.2%. France’s stock market acted as a drag, weighed down by political uncertainty. Towards the end of the quarter, speculation about an additional windfall tax in Italy caused further unease. Switzerland’s Swiss Leader Index (SLI) followed the general trend, rising 2.5% in the third quarter, with a year-to-date gain of 12.2%.

In China, equities declined steadily throughout the quarter until the final week of September, when Beijing’s central government announced and partially implemented comprehensive monetary and fiscal stimulus measures. This led to a sharp recovery, with the Shanghai Composite surging over 20% in just a few days. The index posted a 12.4% quarterly gain, leaving it up 12.2% for the year-to-date. By contrast, Japan’s Nikkei 225 fell 4.2% over the quarter but remained up 13.3% for the year. Early August was particularly dramatic for the Japanese benchmark, which tumbled nearly 20% in just three trading sessions.

Against this positive backdrop, the Palatium equity funds delivered robust performances. The Swiss Equities PLUS R fund gained 12.7% year-to-date, the European Equities PLUS R fund rose by 9.0%, and the North American Equities PLUS R fund advanced 16.4%.

Source: own illustration

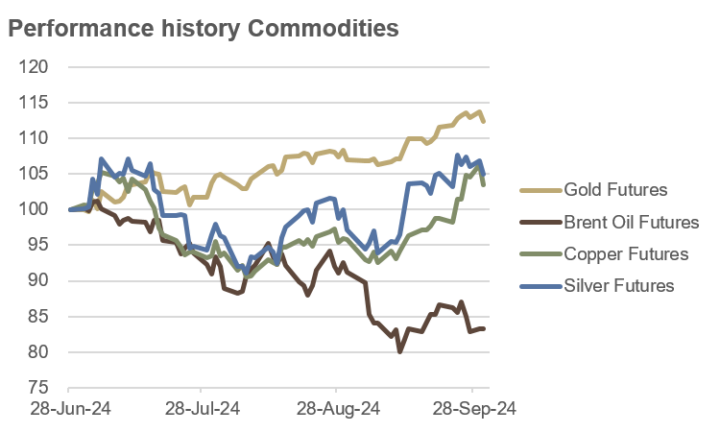

Commodities and Alternative Investments

The performance of gold in the 3rd quarter was particularly impressive. The yellow metal rose by 12.4%, ending the quarter near a new all-time high of $2,685 per ounce. Since the start of the year, gold has surged by 28.2%. Key drivers of this rally included increased purchases by Chinese retail investors, central bank buying, and rising geopolitical tensions. A global decline in interest rates and a weaker US dollar provided additional tailwinds.

Silver prices also climbed, rising by 4.9% over the quarter and posting a year-to-date gain of 31.0%, outperforming gold slightly. Silver is often viewed as a hybrid between an industrial and a precious metal.

Copper prices followed a similar trajectory to silver. After a sharp decline through early August and another dip in early September, copper rebounded by the end of the quarter, closing with a 3.5% gain. Year-to-date, copper has risen by 17.0%. Due to its widespread use in various industries, copper is often seen as a barometer of the global economy, earning it the nickname “Dr. Copper”.

In contrast, crude oil prices declined despite rising tensions in the Middle East. Brent crude fell to $69 per barrel by September 11 and ended the quarter only slightly higher at $72, marking a quarterly drop of 16.7%. Since the start of the year, Brent crude has fallen by 6.6%.

The two leading cryptocurrencies had a mixed quarter: BTC/USD gained 5%, while ETH/USD fell by 23%. Bitcoin is up by 51% year-to-date, while Ether has posted a more modest gain of 14%.

Source: own illustration

Currencies

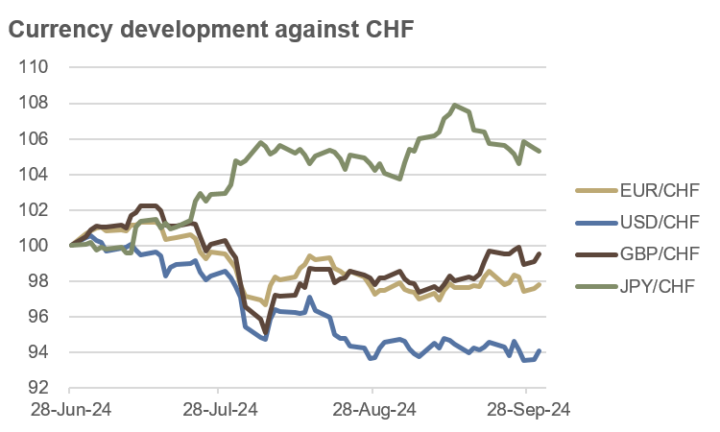

The 3rd quarter was marked by a weakening US dollar. The Dollar Index (DXY), which measures the value of the USD against a basket of six major currencies, declined by 4.8% during the quarter, closing at 100.76, just above its yearly low, which was hit a few days earlier. The market turbulence in early August was particularly impactful, with the USD, EUR, and GBP all seeing significant declines, while traditional safe-haven currencies like the CHF and JPY posted notable gains.

Over the past three months, the dollar lost 5.9% against the Swiss franc (CHF), ending the quarter at 0.845, compared to 0.899 at the end of June. The euro and the pound followed similar trajectories against the CHF, with the GBP faring slightly better, declining by just 0.5%, while the EUR fell by 2.2%. By the end of September, the EUR/CHF exchange rate stood at 0.942, down from 0.963 three months prior, and GBP/CHF at 1.131, down from 1.136. Despite the declines in the 3rd quarter, the pound has gained 5.6% against the CHF since the start of the year, while the euro has advanced by 1.4%. The USD has held onto a narrow year-to-date gain of 0.5% versus the CHF.

A standout performer was the Japanese yen (JPY), which rose 5.3% against the CHF in the 3rd quarter. The yen’s surge was especially pronounced in early August and early September, as global market uncertainties heightened, reinforcing its status as a safe-haven currency. However, year-to-date, the yen remains down 1.4% against the Swiss franc.

Source: own illustration

Outlook

The estimate for US economic growth in the 3rd quarter stands at a solid +2.5% (Atlanta Fed GDPNow, October 1, 2024), following +3.0% growth in the 2nd quarter. Throughout the quarter, the Atlanta Fed’s forecasts fluctuated between 2% and 3%. Simultaneously, the annual rate of headline inflation has shown a downward trend, dropping from 3.0% in June to 2.5% in August. The current estimate for September is 2.3% (Cleveland Fed Inflation Nowcasting, October 4, 2024), bringing it even closer to the 2.0% inflation target. The US unemployment rate also developed positively, falling to 4.1% in September, below expectations.

The upcoming US elections on November 5 do not prompt us to take additional hedging measures or alter our investment process. Only a landslide victory, in which the Democrats secure the presidency along with a majority in both the Senate and the House, could potentially cause market volatility. We view the likelihood of such an outcome as low.

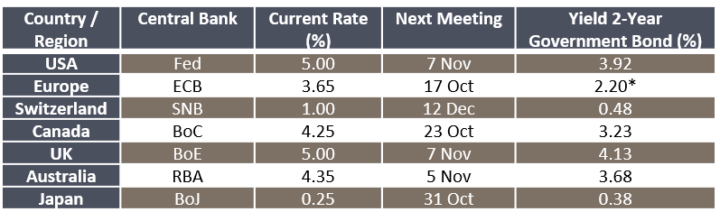

To assess the future direction of central bank interest rate policies, the yields on two-year government bonds provide valuable insights (see table).

Source: own illustration

Fixed Income

The table clearly indicates that the market – excluding Japan – continues to anticipate interest rate cuts by central banks. This expectation is reflected in the difference between current policy rates and the yields on 2-year government bonds.

For the 4th quarter, we expect a slight uptick in inflation rates, driven by extensive stimulus measures in China and escalating conflicts in the Middle East, which could lead to higher commodity and energy prices. Nevertheless, the monetary policy stance of central banks is likely to remain largely unchanged, and we anticipate that they will continue their cycle of rate cuts.

Regarding economic growth, we foresee a gradual shift from consumer spending to capital expenditures, which should promote productivity in the long run. Despite a slight slowdown, growth is expected to remain positive.

In this context, we see potential in energy and commodity equities, as well as in companies poised to benefit from increased capital spending.

Credit

In the 4th quarter, we do not anticipate a recession; however, a mild economic slowdown is expected. In this context, we prefer investment-grade bonds. Within the high-yield bond segment, emerging market bonds in hard currency could particularly benefit from an environment characterized by a weakening USD and a globally declining interest rate landscape.

Regarding some rather esoteric private credit products, there are rumours that valuations are increasingly shifting from a “marked-to-market” approach towards “marked-to-model” or even “marked-to-myth”. Given that many of these credit products are illiquid and not traded on a daily basis, the actual valuation will only become apparent at maturity. We remain cautious regarding these instruments.

Equities

Although October is historically known for downturns and crashes, particularly in US election years, there are currently no indications that the economy or the market are in immediate danger. We do not expect any significant pullbacks before year-end.

For the 4th quarter, we anticipate a stagflation scenario characterized by slightly declining growth and a temporary uptick in inflation rates. Nevertheless, central banks are likely to continue their interest rate cuts. In this environment, sectors such as energy, basic materials, utilities, and IT are expected to perform well. Additionally, we foresee a trend toward increasing capital expenditures, while private consumption remains stagnant. Our preference leans towards the US stock market compared to its European counterpart.

In regard to Chinese equities, we remain cautious. We doubt that the recent political measures enacted by the central government will sustainably encourage consumer and business willingness to spend and invest. The recent threat to place the parent company of Tommy Hilfiger on the national security list sends a clear signal. Similarly, the arrest of an economist who criticized the government in a private chat is unlikely to foster confidence. The planned increase in the retirement age will also hardly support consumer sentiment or stimulate consumption.

Commodities and Alternative Investments

We expect the price of gold to perform positively in the 4th quarter. While we anticipate that prices may experience a moderate decline in October due to temporarily rising interest rates and a stronger USD, they are likely to rebound towards the end of the year, driven by robust demand and positive seasonal trends.

Silver is also expected to exhibit a positive trend throughout the quarter; however, its price fluctuations are approximately three times greater than those of gold. Consequently, we find silver less suitable as a hedge for the portfolio.

Copper appears to be particularly interesting. The positive price momentum that began following the Federal Reserve’s rate cut and recent stimulus measures in China is expected to continue into the 4th quarter. The market’s relatively bearish positioning in the futures market should provide additional support.

Crude oil prices are also likely to rise in the 4th quarter after stabilizing at low levels in recent weeks. These increases are expected to be driven more by supply shocks than by a significantly rising demand. Furthermore, the positioning in the futures market is modest in historical terms, which is also supportive of prices.

Currencies

In currency markets, three independent events at the beginning of October unexpectedly propelled the US dollar (USD). First, discussions on interest rate hikes in Japan have been postponed following the election of a new Prime Minister. Second, inflation in the Eurozone surprisingly came in low at 1.8%, strengthening expectations for an interest rate cut by the European Central Bank (ECB) in October. Third, the Governor of the Bank of England indicated that he is considering lowering interest rates “more aggressively”.

Looking ahead for the remainder of the quarter, we anticipate that the USD will decline after a brief surge. In particular, the Japanese yen (JPY), Australian dollar (AUD), and British pound (GBP) show a notably bullish positioning, suggesting that a depreciation of these currencies would not come as a surprise. In contrast, the positions in the euro (EUR) and Swiss franc (CHF) are only slightly bullish compared to historical norms, making it challenging to make a clear forecast for the 4th quarter.

Conversely, the Mexican peso (MXN) could perform surprisingly well, as positioning in this currency is quite bearish.

Conclusion

For several years now, forecasts of an impending recession have persisted, only to be pushed further into the future quarter by quarter. While these predictions may eventually come to pass, their practical use for daily asset management decisions remains limited.

In the 4th quarter, we anticipate a slight increase in inflation rates alongside a moderate slowdown in economic growth. Nonetheless, central banks are likely to maintain their interest rate reduction cycle.

In this stagflation scenario, we see gold, commodities, and government bonds as well positioned. However, we plan to slightly shorten the duration of our bond holdings. In the credit sector, we prefer investment-grade bonds and focus on emerging market bonds denominated in USD within the high-yield segment. Inflation-protected securities continue to serve as a hedge against unexpected inflationary surges.

In equity markets, we are targeting companies poised to benefit from rising capital expenditures, including utilities and technology firms. Resource and energy stocks also appear promising, whereas we are reducing our exposure to consumer goods and healthcare sectors.

To enhance our diversification strategy, we are integrating trend-following funds, which can mitigate portfolio volatility due to their low or negative correlation with other asset classes.